Minimum wage increase may lessen employment opportunities

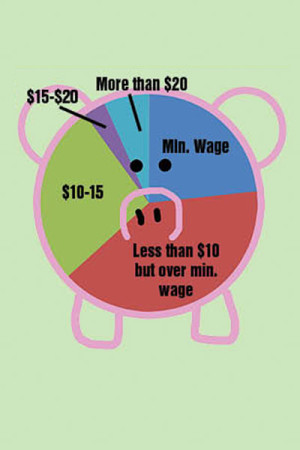

The Patriot conducted a survey on Nov. 22 to find out how much money working students earn. 60% of students make more than minimum wage.

Since 2009, the prices of chicken patty sandwiches and gas have risen, but minimum wage has remained the same. With inflation and low minimum wage, students are starting to feel the need for higher pay.

“Since the prices of everything have gone up, you can’t live off of minimum wage anymore,” junior Danielle Long said. Long is a minimum wage employee and wants a change.

Long is one of the 37 percent of JC students who have a job. 23 percent of those students make minimum wage, according to a survey of the student body conducted by The Patriot on Nov. 22.

In President Barack Obama’s 2013 State of the Union Address, he proposed and called for Congress to raise the national minimum wage to $9.00 per hour by the year 2015.

For many students, raising the minimum wage to $9.00 per hour from $7.25 would mean higher pay, but it could also increase their chances of losing their job. With the last raise of minimum wage in 2009, over 600,000 teenagers lost their job, according to The Daily Caller. Also, according to The Daily Caller, the prices of products could go up.

With the higher prices of products, an anonymous student who responded on the survey said, “It has made me a lot more conscious on what I spend my money on, and I realized how to save and not waste on useless stuff.”

However, students have mixed feelings about the possibility of raising minimum wage. “If the federal minimum wage increases, it would definitely help employees make more money which is great,” senior Catey Minnis said.

The last raise of federal minimum wage was on July 24, 2009. It went from $5.15 per hour to $7.25 per hour. However, employers couldn’t afford their current employment. Teenage employment dropped eight percent in three months, according to The New York Times.

“Small businesses, like the one I used to work for, would struggle to pay their workers. I actually lost my job because the restaurant went out of business, and if minimum wage was higher, I would have been out of a job a lot sooner,” Minnis said.

Many students also struggle with the percent of income taxes taken out of their paychecks.

“It is low when you get your pay check [after taxes are taken out],” senior Hannah Brown said. Brown works two jobs to make the amount of money she needs.

Long said,“They take too much money out with taxes.”

Erica Kelble is a Multimedia Editor for The Patriot and jcpatriot.com.